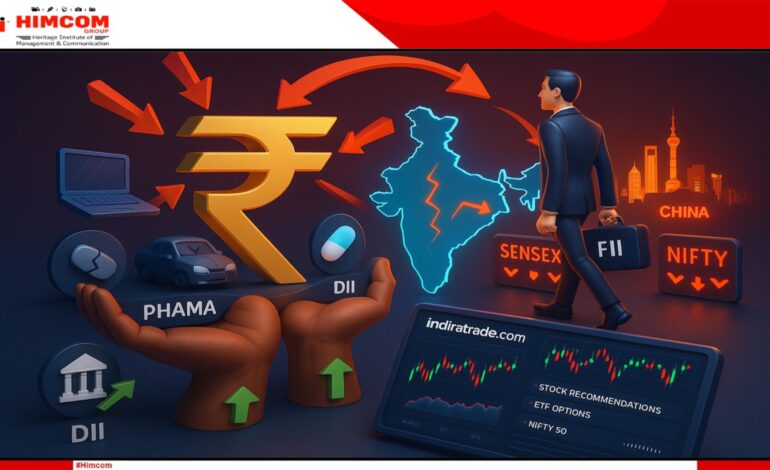

:What’s Happening in the Market:

- Markets are inching up, but tentatively Sensex and Nifty have had a few good sessions lately. The Nifty recently broke above the 25,000 mark again, which is giving some people hope.

However, the gains aren’t super strong; there’s a lot of caution. - Rupee is weak, foreign investors wary

The rupee has dropped to record lows vs. the US dollar (around ₹88-₹88.44 per $) recently.

Part of that is because of new U.S. tariffs on Indian goods, which have rattled confidence. - Some sectors are doing okay; others are under pressure.

Gains: Oil & gas, PSU banks, energy are doing relatively well. Some stocks in oil/gas etc. are picking up.

Struggles: IT is facing pressure—not terrible everywhere, but it’s losing some shine.

- Hope on trade talks & rate moves abroad

There’s optimism because the U.S. and India seem ready to work on resolving trade tensions. This is helping sentiment.

Also, expectations that the U.S. Federal Reserve might begin easing rates (or at least signal it) are being watched closely. If U.S. rates stay high, capital tends to flow out of emerging markets.

What’s Risky / Things to Keep an Eye On

Tariff uncertainty: U.S. tariffs are pressuring export-oriented businesses, hurting trade flows and investor confidence.

Rupee weakness makes imports costlier, inflation risk rises, especially for companies that need raw materials from abroad.

Strong domestic data—good GDP growth, good earnings reports—would help. If companies start delivery.

:My View: What Should Investors Do (or Consider)

If you’re a long-term investor: this might be a time to pick good quality stocks that have strong fundamentals but have got beaten down because of macro worries. Sectors like energy, some of the PSU banks, maybe industrials might have value.

If you’re more short-term or risk-averse: keep an eye on global headwinds (trade wars, Fed rate policy). Don’t heavily load up on sectors that are vulnerable: e.g. high import dependence, or companies with weak margins that can’t absorb rupee depreciation.

Naitik Tyagi

BJMC 3

Leave a Reply

You must be logged in to post a comment.